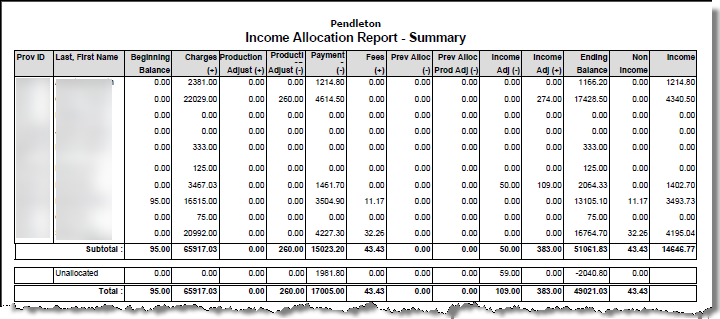

Income Allocation Summary Report

Income Allocation Summary Report Overview

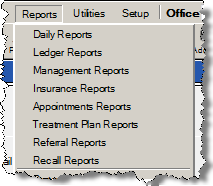

Most QSIDental Web reports are launched from the Reports menu where the reports are organized into categories. These categories make the reports easy to find and use. Management reports focus on data used to get a clear picture of the operations and finances of the practice over a given period.

Run the Income Allocation Summary Report

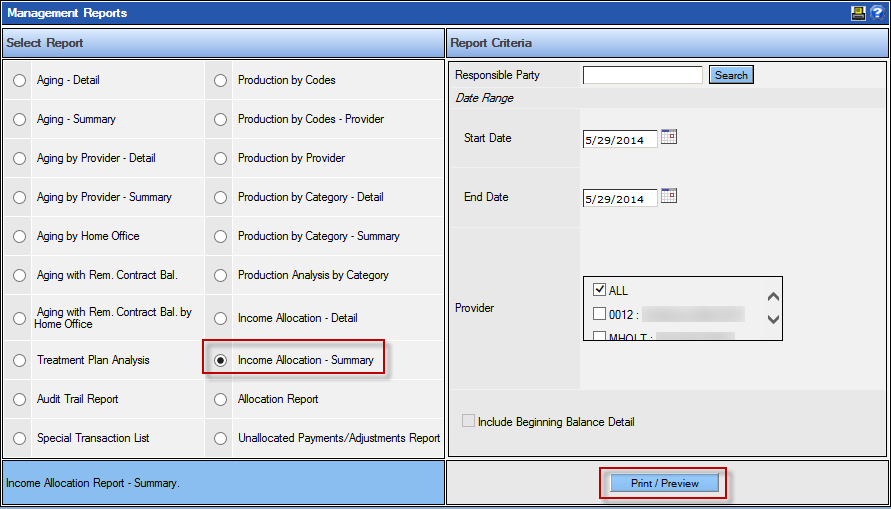

To run the Income Allocation Summary Report:

-

Select Management Reports from the

Reports menu.

- Select Income Allocation – Summary on the left side of the screen.

-

Complete the criteria as desired:

- The report can be run for a specific responsible party. To do so, type part of the desired name in the Responsible Party field and click Search.

- Select the desired date range by typing the dates or by selecting the date from the calendar.

- Select the check boxes beside the desired providers, or use the All check box.

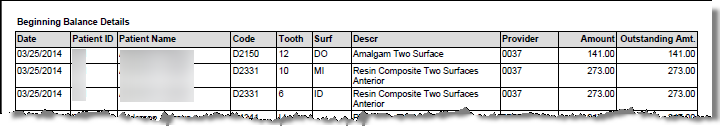

- Select the check box beside Include Beginning Balance Detail if desired.

- Click Print/Preview.

Fields Within the Income Allocation Summary Report

|

Report Column |

Data Source |

Corroborating Report |

|

Provider Identification |

Provider setup -for selected providers |

None |

|

Beginning Balance |

Total AR for this Provider prior to the “Start Date” entered when running the report |

None |

|

Charges |

Procedures posted to patient Ledger within report date range |

Daily Journal by Provider |

|

Production Adjust (+) |

Adjustment codes defined as Type=Adjustment, Subtype=Production, Sign=+ Examples: TRANSFER + Charges To ADJ ON + Fee Adj Per EOB |

Daily Journal by Provider |

|

Production Adjust (-) |

Adjustment codes defined as Type=Adjustment, Subtype=Production, Sign=- Examples: TRANSFER + Charges From ADJ OFF-Cash Discount |

Daily Journal by Provider |

|

Payment (-) |

Payments allocated to charges/debits of a Provider |

Income Allocation Detail |

|

Fees (+) |

Service Fee % defined on Payment Setup Example: Care Credit charges a 10.5% service fee which should not be treated as Income |

Income Allocation Detail |

|

Prev Alloc (-) |

Payments or Collection Adjustments posted prior to the report Start Date that were allocated within the report date range |

Income Allocation Detail |

|

Prev Alloc Prod Adj (-) |

Production Adjustments posted prior to the report Start Date that were allocated within the report date range.These do not impact Income |

None |

|

Income Adj (-) |

Adjustment codes defined as Type=Adjustment, Subtype=Collection, Sign=- Examples: CBO TRANSFER-Payment To CBO Collection Credit Adjust |

Income Allocation Detail Daily Journal by Provider |

|

Income Adj (+) |

Adjustment codes defined as Type=Adjustment, Subtype=Collection, Sign=+ Examples: CBO TRANSFER-Payment From CBO Collection Adjustment |

Daily Journal by Provider |

|

Ending Balance |

Provider balance at End Date of report Calculation: =Beg Bal + Charges + Prod Adj(+) – Prod Adj(-) – Payments – Prev Alloc – Prev Alloc Prod Adj – Inc Adj (-) + Inc Adj(+) |

None |

|

Non Income |

Non-income transactions; Contract Adjustment |

None |

|

Income |

Provider Income Calculation: =Payments – Fees + Prev Alloc + Inc Adj(-) – Inc Adj(+) |

Income Allocation Detail |

|

Unallocated (for a single Provider) |

Any payment or adjustment transaction posted to the specified doctor that is not yet allocated |

Unallocated Payment/ Adjustment Report |