Set Up an ERA Profile

The ERA profile establishes the rule sets and criteria used when posting payments and adjustments from an ERA file for a specific carrier. The profile must be established for each carrier from which the practice receives ERA payments and communications. This setup option is used for customers using the 835 Processing tool.

To set up an ERA Profile:

- Select ERA Profile from the Insurance section under the Setup menu.

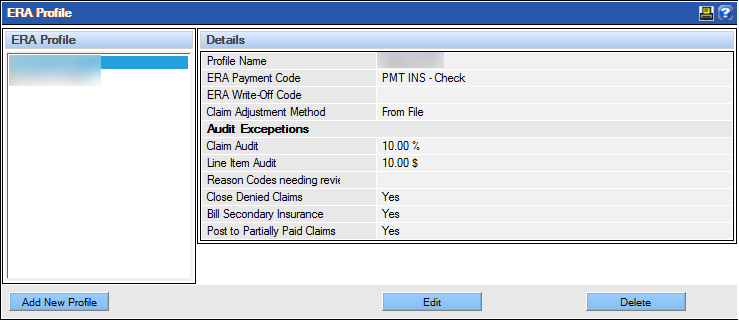

The ERA Profile window displays. The current list of carrier profiles is displayed on the left side of the window, and information about the selected profile is shown on the right. From this window, new profiles may be added, or current ones edited and deleted (based on permissions.)

- Click Add New Profile.

The system displays a form for entering information about the new profile.

- Complete the fields as appropriate for the carrier and practice using the following field descriptions as a guide:

- Profile Name: Type the name to describe the specific profile within the 30 character limit. It is helpful to identify the carrier in the profile name.

- ERA Payment Code: Select the payment type to indicate how the payments will be identified in the Ledger and in reports. Only codes designated as insurance payments will appear as options in the dropdown list.

- ERA Write Off Code: Select the payment/adjustment type to indicate how any write offs will be identified in the Ledger and in reports. Note: To appear within the list, the payment/adjustment type must be established with the “Insurance adjustment” class.

- Claim Adjustment Method: Select the method to handle adjustments to claims when the amount received differs from the amount expected. The selection typically depends on how the claims are billed –based on UCR or on the amount expected (contracted).

- Select From File if the amount that is billed to the insurance company is the same as the amount charged in QSIDental Web. Adjustments will be based on the amounts in the EOB and 835 file and will be passed to the patient.

- Select From Remaining Expected if the amount that is billed to the insurance company is different from the amount charged in QSIDental Web. Adjustments will be based on the remaining amount expected from the insurance company and will not be passed to the patient.

- Claim Audit: Specify which claims should be reviewed when the amount received is less than the amount expected based on a set threshold. These claims will be available for an audit in the Batch Insurance Payment -835 module.

- Claim $ or %: Indicate a numerical value and specify dollars ($) or percentage (%) to set the threshold for the entire claim. For example if $25 is set, a claim will be considered as paying less if the insurance payment is short by more than $25. A claim that is short $22 will not be identified as paid less.

- Line Item $ or %: Indicate a numerical value and specify dollars ($) or percentage (%) to set the threshold for a line item. For example if $5 is set, a line item will be considered as paying less if the insurance payment is short by more than $5. A line item that is short $4 will not be identified as paid less.

- Reason Codes Needing Review: Enter the carrier reason code(s) that will cause a Partial status to be assigned to a claim when one or more of the line items on the claim are denied. Separate multiple codes with commas (,) for up to 100 characters.

- Close Denied Claims: Select Yes or No to indicate if the claim should be automatically marked as “closed” when the claim is denied.

- Bill Secondary Insurance: Select Yes or No to indicate if the patient’s secondary insurance should be billed automatically when the claim is closed.

- Post to Partially Paid Claims: Select Yes or No to allow additional payments to be posted to claims that have been partially paid but not yet closed.

- Click Save.